If you're looking to make a career out of being a financial advisor, there are a few things you need to remember. This article will discuss the characteristics of a good financial advisor, the job duties of a financial advisor, and how to market yourself as a financial advisor. In this article, you'll learn how to establish a process which will help you succeed as a financial planner.

A good financial advisor is able to identify the following characteristics

A strong financial advisor must be able to build a relationship with clients. This requires being open to listening to the client and willing to share your feelings. This is crucial to building a lasting relationship. Advisors should be able and willing to explain financial concepts in a clear and concise manner. Clients should be able to ask questions.

Job duties of a financial advisor

Job duties of a successful financial advisor include consultation and advice to clients regarding their financial needs. The job also requires you to manage administrative tasks, customer followups, referral activities, as well as complying with regulatory requirements. You will need to have exceptional communication skills, time management skills, and the ability to network.

You can market yourself as a financial planner

There are many different ways to market your financial advisor business, but the most important one is to make a strong social media presence. LinkedIn, Facebook, Twitter, and Twitter are all great platforms to establish your expertise and build your brand. To share content on a specific topic that interests you, you can also start a blog. Your goal is to make you brand visible to a wide audience.

A process to help you succeed as a financial adviser

A financial advisor's success depends on the process. It is a vital component of the client experience and is essential for scaling a team. It serves as an operational manual.

Develop a specialization

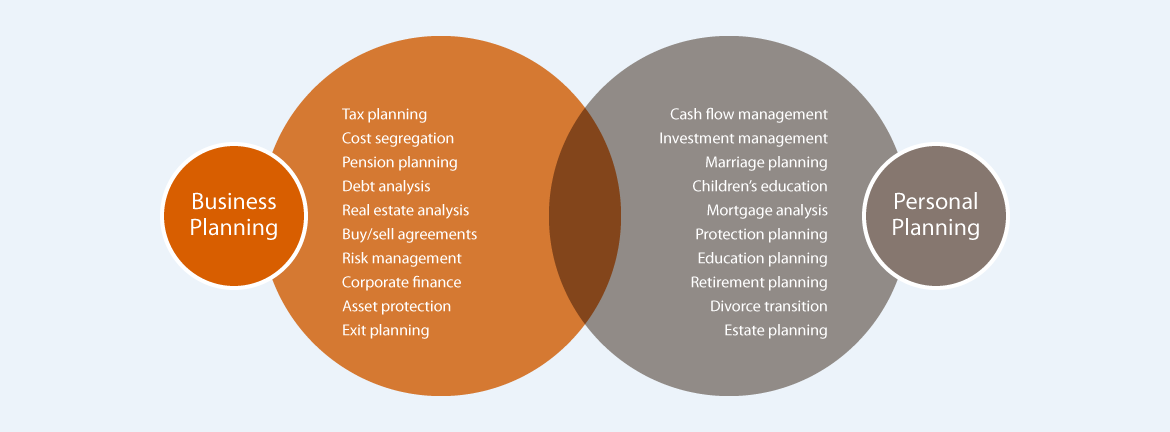

A financial advisor's specialty requires thinking beyond the basics. Although most financial advisors are focused on serving their clients, some have particular interests or specialized skills. For example, some advisors enjoy working with clients in particular age groups or careers. If you find yourself in these situations, a specialty can allow you to reach clients consistently that you enjoy working with.

Avoiding hot-shot planners

To be successful as a financial advisor, you must avoid selling hot-shot planners. These professionals have strong incentives to sell their clients expensive products. In addition to being paid commissions, they also need to justify their sales to their clients. While they may be experts at what their clients need, they may not be the right investment advisors for them.

FAQ

How old do I have to start wealth-management?

Wealth Management can be best started when you're young enough not to feel overwhelmed by reality but still able to reap the benefits.

The sooner you invest, the more money that you will make throughout your life.

If you want to have children, then it might be worth considering starting earlier.

Savings can be a burden if you wait until later in your life.

What are the benefits associated with wealth management?

Wealth management offers the advantage that you can access financial services at any hour. Savings for the future don't have a time limit. If you are looking to save money for a rainy-day, it is also logical.

There are many ways you can put your savings to work for your best interests.

For instance, you could invest your money into shares or bonds to earn interest. To increase your income, property could be purchased.

A wealth manager will take care of your money if you choose to use them. This will allow you to relax and not worry about your investments.

What are the most effective strategies to increase wealth?

It's important to create an environment where everyone can succeed. You don’t want to have the responsibility of going out and finding the money. If you're not careful, you'll spend all your time looking for ways to make money instead of creating wealth.

Avoiding debt is another important goal. While it's tempting to borrow money to make ends meet, you need to repay the debt as soon as you can.

You're setting yourself up to fail if you don't have enough money for your daily living expenses. You will also lose any savings for retirement if you fail.

Before you begin saving money, ensure that you have enough money to support your family.

What is a Financial Planner? How can they help with wealth management?

A financial planner is someone who can help you create a financial plan. They can evaluate your current financial situation, identify weak areas, and suggest ways to improve.

Financial planners are trained professionals who can help you develop a sound financial plan. They can assist you in determining how much you need to save each week, which investments offer the highest returns, as well as whether it makes sense for you to borrow against your house equity.

Financial planners usually get paid based on how much advice they provide. Some planners provide free services for clients who meet certain criteria.

What is estate planning?

Estate Planning is the process that prepares for your death by creating an estate planning which includes documents such trusts, powers, wills, health care directives and more. These documents are necessary to protect your assets and ensure you can continue to manage them after you die.

Statistics

- As of 2020, it is estimated that the wealth management industry had an AUM of upwards of $112 trillion globally. (investopedia.com)

- These rates generally reside somewhere around 1% of AUM annually, though rates usually drop as you invest more with the firm. (yahoo.com)

- US resident who opens a new IBKR Pro individual or joint account receives a 0.25% rate reduction on margin loans. (nerdwallet.com)

- Newer, fully-automated Roboadvisor platforms intended as wealth management tools for ordinary individuals often charge far less than 1% per year of AUM and come with low minimum account balances to get started. (investopedia.com)

External Links

How To

How to save money on your salary

To save money from your salary, you must put in a lot of effort to save. If you want to save money from your salary, then you must follow these steps :

-

It is important to start working sooner.

-

It is important to cut down on unnecessary expenditures.

-

Use online shopping sites like Flipkart and Amazon.

-

You should do your homework at night.

-

You must take care your health.

-

You should try to increase your income.

-

A frugal lifestyle is best.

-

You should learn new things.

-

Share your knowledge with others.

-

You should read books regularly.

-

It is important to make friends with wealthy people.

-

It's important to save money every month.

-

Save money for rainy day expenses

-

You should plan your future.

-

You shouldn't waste time.

-

Positive thoughts are important.

-

Avoid negative thoughts.

-

Prioritize God and Religion.

-

It is important to have good relationships with your fellow humans.

-

Enjoy your hobbies.

-

Be self-reliant.

-

Spend less than you make.

-

It's important to be busy.

-

You should be patient.

-

You must always remember that someday everything will stop. It's better to be prepared.

-

Never borrow money from banks.

-

Always try to solve problems before they happen.

-

You should try to get more education.

-

Financial management is essential.

-

It is important to be open with others.