The salary of a financial advisor in Texas can vary greatly depending on factors like experience, location, and employer. If you possess the necessary skills and expertise, this career can be very lucrative. Be sure to do your research and find a financial advisor who fits your needs.

What is the average salary of a financial advisor?

A financial advisor can earn commissions on products they sell. However, this can lead to conflicts of interest because it could influence their recommendations. It is usually more common for advisors to work on a salary basis instead of earning money from commissions.

Finding a financial planner that meets your needs

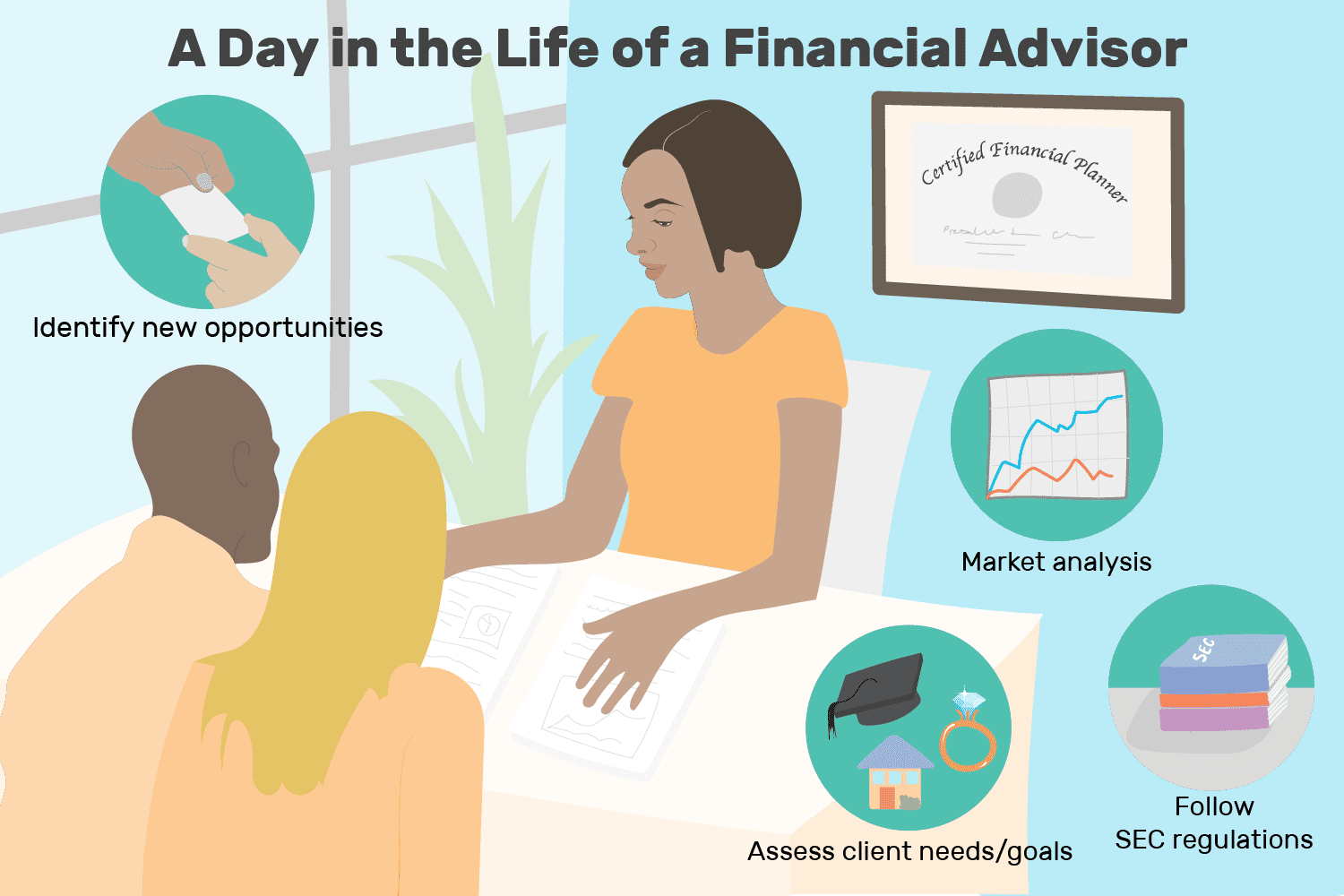

A financial advisor is required to have a Bachelor's Degree in Finance, Accounting or a related area and professional qualifications including the CFP Certification. They must also possess strong interpersonal and communication skills, as well as the ability to solve problems and analyze them.

Find out what the best financial advisor is for you

You can find reviews on websites of financial advisors. Ask friends and family members who have previously worked with financial advisors for their opinions. You will get a better idea of the personality, communication style, and fit with your needs.

If you are looking for a company to offer only fee-based service, then they will not be earning commissions off of financial products or from insurance. This will allow you to avoid conflicts of interests and ensure they put your needs above their own.

How to Find a Financial Advisor in Dallas

If you live in the Dallas area and are interested in working with a financial advisor, consider visiting Lee Financial Planning, which has been providing services to clients since 1975. The firm's philosophy centers on the clients' entire financial picture. The firm will first understand your income, savings and investments before developing a plan to help you manage your finances.

The average salary for a financial consultant in Dallas is $108,359, which is 16% above the national average and more than four times the average in Texas. The top 5% of consultants in the state make more than $208,000, and the lowest 10% make less than $44,100.

Finding a good financial planner

If you want to work with a Financial Advisor, you need to be aware of all the possible risks. They may have an incentive for them to sell certain products over others, which could mean lower investment returns or a poorer outcome in retirement.

Financial planners are employed by many companies in Dallas and throughout the United States. These firms offer a range of services such as estate planning, asset planning, and 401k investment planning. Smaller firms may not offer these services, so do your research and make sure that the firm you select is right for you.

FAQ

Why it is important to manage your wealth?

The first step toward financial freedom is to take control of your money. You must understand what you have, where it is going, and how much it costs.

It is also important to determine if you are adequately saving for retirement, paying off your debts, or building an emergency fund.

If you fail to do so, you could spend all your savings on unexpected costs like medical bills or car repairs.

How to Choose an Investment Advisor

Choosing an investment advisor is similar to selecting a financial planner. Experience and fees are the two most important factors to consider.

This refers to the experience of the advisor over the years.

Fees are the price of the service. It is important to compare the costs with the potential return.

It's crucial to find a qualified advisor who is able to understand your situation and recommend a package that will work for you.

What Are Some Examples of Different Investment Types That Can be Used To Build Wealth

You have many options for building wealth. These are just a few examples.

-

Stocks & Bonds

-

Mutual Funds

-

Real Estate

-

Gold

-

Other Assets

Each has its benefits and drawbacks. Stocks and bonds, for example, are simple to understand and manage. However, they can fluctuate in their value over time and require active administration. Real estate on the other side tends to keep its value higher than other assets, such as gold and mutual fund.

Finding the right investment for you is key. You need to understand your risk tolerance, income requirements, and investment goals in order to choose the best investment.

Once you have determined the type of asset you would prefer to invest, you can start talking to a wealth manager and financial planner about selecting the best one.

Where to start your search for a wealth management service

If you are looking for a wealth management company, make sure it meets these criteria:

-

Has a proven track record

-

Locally based

-

Consultations are free

-

Provides ongoing support

-

Is there a clear fee structure

-

Excellent reputation

-

It's easy to reach us

-

Offers 24/7 customer care

-

Offering a variety of products

-

Low charges

-

Do not charge hidden fees

-

Doesn't require large upfront deposits

-

Have a plan for your finances

-

Has a transparent approach to managing your money

-

Allows you to easily ask questions

-

A solid understanding of your current situation

-

Understanding your goals and objectives

-

Is available to work with your regularly

-

Works within your budget

-

Good knowledge of the local markets

-

We are willing to offer our advice and suggestions on how to improve your portfolio.

-

Is available to assist you in setting realistic expectations

Statistics

- A recent survey of financial advisors finds the median advisory fee (up to $1 million AUM) is just around 1%.1 (investopedia.com)

- Newer, fully-automated Roboadvisor platforms intended as wealth management tools for ordinary individuals often charge far less than 1% per year of AUM and come with low minimum account balances to get started. (investopedia.com)

- These rates generally reside somewhere around 1% of AUM annually, though rates usually drop as you invest more with the firm. (yahoo.com)

- If you are working with a private firm owned by an advisor, any advisory fees (generally around 1%) would go to the advisor. (nerdwallet.com)

External Links

How To

How to invest once you're retired

Retirees have enough money to be able to live comfortably on their own after they retire. But how can they invest that money? You can put it in savings accounts but there are other options. One option is to sell your house and then use the profits to purchase shares of companies that you believe will increase in price. You could also purchase life insurance and pass it on to your children or grandchildren.

You should think about investing in property if your retirement plan is to last longer. You might see a return on your investment if you purchase a property now. Property prices tends to increase over time. If you're worried about inflation, then you could also look into buying gold coins. They don’t lose value as other assets, so they are less likely fall in value when there is economic uncertainty.