A financial advisor's day is full of many duties. She must manage her time, client relationships, and market news. She must keep in touch with clients via phone calls and emails. Client meetings, portfolio evaluations and planning for retirement are just some of the many tasks she handles. She may also be responsible for spreadsheets and coordination of investment accounts with estate planning.

A typical day for financial advisors

A typical day as a financial professional involves many different tasks. Advisors often start their day by serving current clients and reviewing their portfolios. They also respond to client questions. Advisors who begin their day this way report significantly higher rates of new client acquisitions than those who don't service existing clients.

Financial advisors generally spend 41% on administrative tasks and 59% of their time dealing with clients. They must be focused on growing and strengthening client relationships. They should also be looking at both short-term market gains and long-term strategies to save for retirement.

Duties

A financial advisor's duties include working with clients and making sure that they make the right choices. They must be knowledgeable about the markets and must be able to interpret financial information. Numerous financial advisors offer seminars to help their clients learn about different investments. Federal regulations are also required.

Duties of a financial advisor may also involve traveling and attending conferences. A bachelor's degree usually is required to do the job. While employers don't specify what degree is required, many employers prefer applicants who have studied economics, finance, and accounting. Employers may prefer applicants who have a background in math-related fields.

Time management

Advisors often struggle with time management. Advisors must manage their personal, family, and work lives. Additionally, they need to find ways for more achievements and conversations to be squeezed into each day. Time management in the life of a financial advisor can be challenging, but not impossible. Advisors can achieve more in less time by using a new approach.

Time management involves maximizing productivity by prioritizing fundamental tasks and activities. First, identify your goals. It is important to clearly define your goals, both personal and business. Once you have them, you will be able to prioritize your day.

Management of clients

Financial advisors must manage clients. Not only does this position help the financial advisor respond to clients' inquiries, it also helps the financial advisor manage the workload by tracking client calls and emails. Client service associates also help advisors to write communications and maintain client information.

In order to help clients determine their goals and needs, financial advisors must first collect information. To plan their financial future, advisors need to ask the client questions about their life, career, and money relationships. After obtaining this information, financial advisors must analyze data and generate strategies. This includes producing income projections and investment reports.

Continuing education

Continuing education for financial advisers is essential to maintaining industry-leading competency standards. NAPFA-Registered Advisors must complete 60 CEs per two-year CE cycle. These cycles begin on January 1, an even-numbered, and end December 31, the following year. The Learning Center allows members of the NAPFA to review their CE history.

Continuing education for financial advisors includes a variety of online and classroom options. Super CE, which is a self study course, allows advisors to complete many hours of CE within a single session. Advisors who want to improve their knowledge while quickly earning CE credits will appreciate this type of program.

FAQ

How do I get started with Wealth Management?

The first step in Wealth Management is to decide which type of service you would like. There are many Wealth Management options, but most people fall in one of three categories.

-

Investment Advisory Services – These experts will help you decide how much money to invest and where to put it. They also provide investment advice, including portfolio construction and asset allocation.

-

Financial Planning Services: This professional will work closely with you to develop a comprehensive financial plan. It will take into consideration your goals, objectives and personal circumstances. He or she may recommend certain investments based on their experience and expertise.

-

Estate Planning Services - An experienced lawyer can advise you about the best way to protect yourself and your loved ones from potential problems that could arise when you die.

-

Ensure that a professional you hire is registered with FINRA. You can find another person who is more comfortable working with them if they aren't.

What are the benefits associated with wealth management?

Wealth management has the main advantage of allowing you to access financial services whenever you need them. Savings for the future don't have a time limit. You can also save money for the future by doing this.

To get the best out of your savings, you can invest it in different ways.

You could invest your money in bonds or shares to make interest. To increase your income, property could be purchased.

If you hire a wealth management company, you will have someone else managing your money. This will allow you to relax and not worry about your investments.

How to Select an Investment Advisor

Choosing an investment advisor is similar to selecting a financial planner. Experience and fees are the two most important factors to consider.

It refers the length of time the advisor has worked in the industry.

Fees are the price of the service. These fees should be compared with the potential returns.

It is crucial to find an advisor that understands your needs and can offer you a plan that works for you.

What is a financial planner? And how can they help you manage your wealth?

A financial advisor can help you to create a financial strategy. They can help you assess your financial situation, identify your weaknesses, and suggest ways that you can improve it.

Financial planners can help you make a sound financial plan. They can tell you how much money you should save each month, what investments are best for you, and whether borrowing against your home equity is a good idea.

Financial planners usually get paid based on how much advice they provide. However, some planners offer free services to clients who meet certain criteria.

How much do I have to pay for Retirement Planning

No. You don't need to pay for any of this. We offer free consultations so we can show your what's possible. Then you can decide if our services are for you.

Statistics

- As previously mentioned, according to a 2017 study, stocks were found to be a highly successful investment, with the rate of return averaging around seven percent. (fortunebuilders.com)

- According to a 2017 study, the average rate of return for real estate over a roughly 150-year period was around eight percent. (fortunebuilders.com)

- As of 2020, it is estimated that the wealth management industry had an AUM of upwards of $112 trillion globally. (investopedia.com)

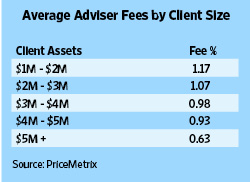

- If you are working with a private firm owned by an advisor, any advisory fees (generally around 1%) would go to the advisor. (nerdwallet.com)

External Links

How To

How to Beat the Inflation by Investing

Inflation can be a major factor in your financial security. Inflation has been increasing steadily for the past few decades, it has been shown. Each country's inflation rate is different. India, for instance, has a much higher rate of inflation than China. This means that your savings may not be enough to pay for your future needs. You could lose out on income opportunities if you don’t invest regularly. So, how can you combat inflation?

Stocks can be a way to beat inflation. Stocks can offer a high return on your investment (ROI). These funds can also be used to buy real estate, gold, and silver. You should be careful before you start investing in stocks.

First, decide which stock market you would like to be a part of. Do you prefer small or large-cap businesses? Decide accordingly. Next, you need to understand the nature and purpose of the stock exchange that you are entering. Is it growth stocks, or value stocks that you are interested in? Decide accordingly. Learn about the risks associated with each stock market. There are many stocks on the stock market today. Some are dangerous, others are safer. Make wise choices.

If you are planning to invest in the stock market, make sure you take advice from experts. They can help you determine if you are making the right investment decision. Also, if you plan to invest in the stock markets, make sure you diversify your portfolio. Diversifying your investments increases your chance of making a decent income. If you only invest in one company, then you run the risk of losing everything.

A financial advisor can be consulted if you still require assistance. These experts will help you navigate the process of investing. They will make sure you pick the right stock. They will help you decide when to exit the stock exchange, depending on your goals.