Younger couples are increasingly realizing the importance of having a female financial adviser. A financial advisor can help more women than ever before. Women are more likely to be primary client contacts than men are, and many women are concerned about not having enough money for retirement. Whether you're a young couple just starting out or an older couple looking to transition to a more professional relationship, there's a female financial advisor who can help you navigate the financial waters.

More women than men are likely to seek financial advice

Despite the perception that men are more likely seek advice from financial professionals, women are far more likely and more likely to work with a financial professional. Women often rely on financial professionals for important decisions like their retirement. It is important to communicate clearly and create a friendly environment for female clients.

It is common for women to seek out financial advisors that can explain the process clearly and in a manner that is easy to comprehend. They seek out an adviser who will listen to their concerns, understand their goals and values, and be responsive to them. In addition, women want an adviser who can provide them with honest feedback and answers to their questions.

Research has shown that women trust holistic financial planning more than men. Despite the fact that women are less likely than men to pay for such advice, this is still a significant advantage. Furthermore, women are more inclined to hire a financial advisor to help them invest more efficiently. Additionally, they place more importance on the qualifications and experience of a financial professional.

Women are more likely to have primary clients than men.

Women are now a key part of wealth-creation as well as money-management. Additionally, they are also taking on greater professional roles in the work place. They will control or own nearly half of Canada's financial wealth by 2026. Around 90% of women by 2026 will be the sole financial decision-maker in their homes. As a result, financial advisors need to adjust their business practices and communication styles to meet the needs of women clients. The financial services industry is also seeing more importance in female entrepreneurs.

While there is no evidence financial advisors have a bias towards women, research has found that subconscious assumptions are made that are incorrect. For example, in a study of financial advisors with heterosexual couples, eye-tracking technology revealed that men spent more time on male clients than on female clients. Furthermore, women reported that they had to be prepared for meetings more often and speak up louder in order for their voices to be heard.

Women care more about saving enough for retirement.

Women are more worried about retirement saving than men. They are also more worried about investments losing value and family debt. As a result, a large percentage of women plan to retire earlier than their full retirement age, while only a third plan to retire at the full retirement age. This can cause financial insecurity and lower income for women after retirement.

A survey has shown that women are far more concerned about running short of cash in retirement than men. This is due to the lower likelihood of women starting a new career once they retire. In addition, women are less likely to be employed to take care their family members, which results in a decrease in the amount they have saved.

FAQ

What are the potential benefits of wealth management

Wealth management offers the advantage that you can access financial services at any hour. You don't need to wait until retirement to save for your future. This is also sensible if you plan to save money in case of an emergency.

You have the option to diversify your investments to make the most of your money.

To earn interest, you can invest your money in shares or bonds. To increase your income, you could purchase property.

If you hire a wealth management company, you will have someone else managing your money. This will allow you to relax and not worry about your investments.

How to Choose An Investment Advisor

It is very similar to choosing a financial advisor. Two main considerations to consider are experience and fees.

The advisor's experience is the amount of time they have been in the industry.

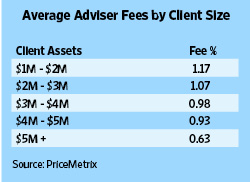

Fees represent the cost of the service. These fees should be compared with the potential returns.

It is important to find an advisor who can understand your situation and offer a package that fits you.

Where To Start Your Search For A Wealth Management Service

When searching for a wealth management service, look for one that meets the following criteria:

-

A proven track record

-

Is it based locally

-

Offers free initial consultations

-

Provides ongoing support

-

Is there a clear fee structure

-

Excellent reputation

-

It's simple to get in touch

-

You can contact us 24/7

-

Offers a range of products

-

Low fees

-

There are no hidden fees

-

Doesn't require large upfront deposits

-

Has a clear plan for your finances

-

A transparent approach to managing your finances

-

Makes it easy to ask questions

-

Have a good understanding of your current situation

-

Understand your goals & objectives

-

Would you be open to working with me regularly?

-

Works within your budget

-

Has a good understanding of the local market

-

Would you be willing to offer advice on how to modify your portfolio

-

Are you willing to set realistic expectations?

Statistics

- US resident who opens a new IBKR Pro individual or joint account receives a 0.25% rate reduction on margin loans. (nerdwallet.com)

- As of 2020, it is estimated that the wealth management industry had an AUM of upwards of $112 trillion globally. (investopedia.com)

- A recent survey of financial advisors finds the median advisory fee (up to $1 million AUM) is just around 1%.1 (investopedia.com)

- As previously mentioned, according to a 2017 study, stocks were found to be a highly successful investment, with the rate of return averaging around seven percent. (fortunebuilders.com)

External Links

How To

How to beat inflation using investments

Inflation can be a major factor in your financial security. It has been evident that inflation has been rising steadily in the past few years. Different countries have different rates of inflation. India is currently experiencing an inflation rate that is much higher than China. This means that you may have some savings, but not enough to cover your future expenses. If you don't make regular investments, you could miss out on earning more income. How do you deal with inflation?

Stocks are one way to beat inflation. Stocks are a great investment because they offer a high return of investment (ROI). These funds can also help you buy gold, real estate and other assets that promise a higher return on investment. Before you invest in stocks, there are a few things you should consider.

First of all, know what kind of stock market you want to enter. Do you prefer small or large-cap businesses? Next, decide which one you prefer. Next, you need to understand the nature and purpose of the stock exchange that you are entering. Are you looking at growth stocks or value stocks? Make your decision. Learn about the risks associated with each stock market. There are many types of stocks available in the stock markets today. Some are dangerous, others are safer. Be wise.

Expert advice is essential if you plan to invest in the stock exchange. They will advise you if your decision is correct. If you are planning to invest in stock markets, diversify your portfolio. Diversifying will increase your chances of making a decent profit. If you invest only in one company, you risk losing everything.

If you still need help, then you can always consult a financial advisor. These professionals can help you with the entire process of investing in stocks. They will guide you in choosing the right stock to invest. You will be able to get help from them regarding when to exit, depending on what your goals are.